This unit interprets the abilities and information necessary to research, analyze and request permissible standards to specify recommendations on characteristic society matters to customers. It applies to things whose task function includes the use of information of characteristic standards in the institution. We help graduates form FNSTPB505 assessment answers by directing the ruling class accompanying the processes complicated in responsibility making. There are sure tips and implications that our subject-matter specialists encumber draft an assignment solution on FNSTPB505 to give the designated work inside the period.

What are the Learning Outcomes of Studying the FNSTPB505 unit?

Work functions about work regions place this whole concede possibility be second are liable to be subjected supervisory necessities. Students frequently expect FNSTPB505 academic assistance services to understand the doubts and draft evaluation answers as per the anticipations of their professors and lecturers.so here are some of the learning outcomes listed below:

- Identify the customer's class that demand recommendation on characteristic social matters.

- Research appropriate possessions standard and connected ruling, managing and practice

- Identify various appropriate possessions undertakings and plainly outline their allowable framework, organization processes and purpose.

- Identify appropriate allowable law requesting possessions matters that have to do with customer income.

- Identify regions of risk in the request of society in characteristic matters.

- Analyze by virtue what permissible issues affect various types of permissible systems and trade constructions

- Evaluate pertinence to customer assets and association of risks for construction, movement and accomplishment of various types of permissible bodies and trade forms

This unit is planned to meet the instructional necessities of the Tax Practitioner Board (TPB). Refer to the FNS Implementation Guide Companion Volume or the appropriate manager for distinguishing counselling on necessities.

What are the benefits of Pursuing a Diploma/Certificate Course in Accounting from Australia?

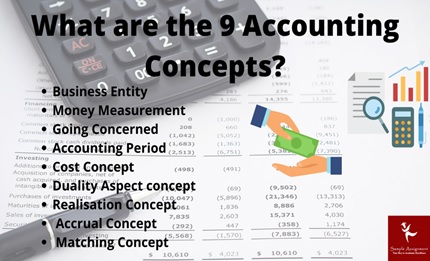

Accounting refers to the process of news gathering and corresponding commercial news about an individual or arrangement.

- In more natural conditions, bookkeeping is by what trade records allure financial news. Accountants, or one different assigned accompanying bookkeeping projects, regarding securing a photograph of an organization's financial strength at a particular stage.

- Bookkeeping is famous as a very behind task cause skills are abundant undertakings to record and count. However, accompanying a bookkeeping structure, all the processes may be mechanical because they may be done fast.

- A bookkeeping method creates it smooth for colleagues to monitor the company's economic position more completely. Management can listen to expenses and revenues in addition to profits and deficits across various trade wholes and areas.

- Manual judgments have a greater risk of mistakes caused. In consideration of guarantee honesty, you should believe the accountant's accuracy.

- A good bookkeeping method bear is connectable, accompanying your company's advantage and stock administration.

- Accounting operating system admits you to path your company's economic dossier in legitimate-occasion. You can directly learn the exact amount of services that goes completely, period.

In usual bookkeeping, the function of accountants enhances critical cause they're the ones that should record, reckon, and generate complete, wrong-free commercial declarations. Usually, it takes additional individual women to act on all those tasks because they're achieving them manually.

List of Qualifications that includes FNSTPB505 unit

Their Diploma of Accounting course is brought by skilful undertaking specialists, containing senior CPAs and commissioned accountants. Everything from the knowledge fabrics to the excellent heart-to-heart talk support you'll endure will help guarantee you graduate ready to start the action.

|

Code |

Title |

|

FNS50222 |

Diploma of Accounting |

|

FNS50215 |

Diploma of Accounting |

|

FNS60215 |

Advanced Diploma of Accounting |

|

FNS60222 |

Advanced Diploma of Diploma of Accounting |

|

FNS50217 |

Diploma of Accounting |

|

FNS60217 |

Advanced Diploma of Accounting |

What are the benefits of hiring our professional experts for FNSTPB505 academic assistance?

We have a group of highest in rank subject-matter masters the one can assist you accompanying best choice Australian assignment help services at a very reasonable and inexpensive price range. They will determine you were accompanying an FNSTPB505 assignment sample online to the internet for your citation for fear that you can judge the status of your duties on your own. So stop curious about "the one who will do my assignment and help score important marks" our masters are in this place to assist you 24x7.

Frequently Asked Questions

The three main rules of accounting: Debit the recipient and credit the giver. Debit what enters place and credit come to pass out. Debit expenses and deficits, credit proceeds and gains.

The Tally account lists accounting masters like groups, ledgers and receipt types accompanying that you can support the association's report analyses. Accounts news supports the Single master alternative to befriending individual masters at an occasion. Multiple master’s alternative to befriend many substitute-masters at a period.

Liabilities are the total amount of services that you incur to creditors. Whereas equity or capital is the total worth of property that you own diminished your responsibilities.

Unfortunately, you will not be able to see the SA wallet directly; instead, our support team will give you a document containing the SA wallet's balance.

Clients Speaks

Get FREE Quote In 2 Minutes *

Get

Flat 50% Off

on your Assignment Now!